Solar Tariffs Are Here: The Sky Is NOT Falling, but the Sunshine Still Does

The wait is over. Almost one year after the original trade case petition was filed, following months of hearings, negotiations, and a final recommendation from the U.S. International Trade Commission, President Trump announced that the U.S. would impose a tariff of 30% on crystalline solar cells and modules produced outside of America, ramping down over the next four years.

Of course, 30% sounds like a lot, and for large utility-scale systems where the solar module represents a large portion of the total installed cost there is a significant impact. However for homeowners, the actual financial impact considering the purchase of a solar energy system is quite small. Let’s dig into the numbers to see why.

How will the new solar tariff affect home solar?

A solar module costs an installer roughly 70 cents per watt to purchase, accounting for the fact that the residential market has a strong preference for high quality brands such as LG, Panasonic, and SunPower. So a 30% tariff would add 21 cents to that cost, for a total of 91 cents per watt for the modules.

That 70 cent per watt module is part of an entire system with other equipment, labor, permitting, sales and marketing costs. All in, a typical home solar system on the Solar.com platform sells for $3.30 per watt installed, before any unique case cost adders. So the post-tariff cost is now $3.51 per watt, or 6% higher.

For homeowners considering a solar system purchase, the gut reaction can often be: “Oh the cost of solar just went up, I missed my opportunity, now must NOT be a good time to add solar”.

Spoiler alert: That decision could cost you $10,000+

Is it better to wait until the solar tariff ends?

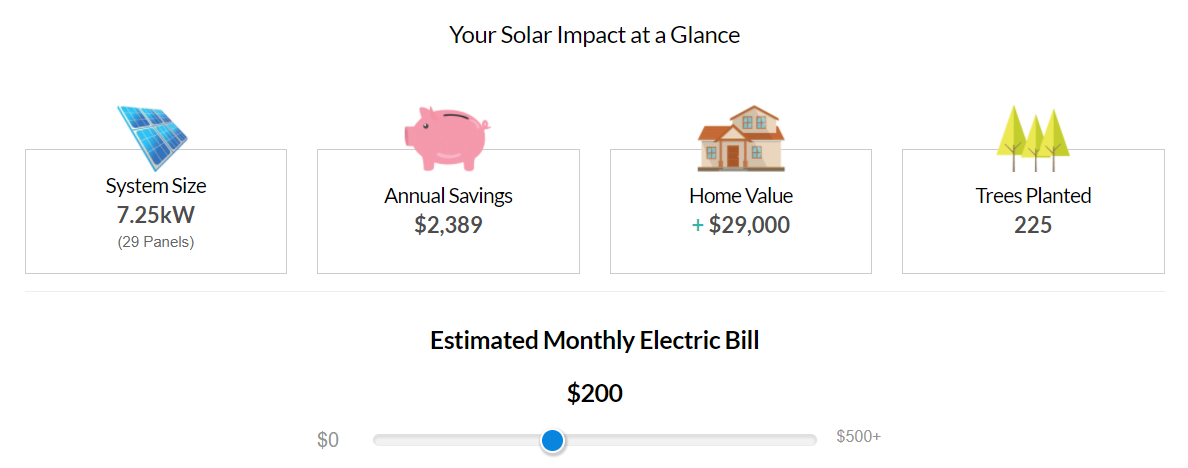

Let’s look at a Southern California homeowner with an average $200/month electricity bill. A 7.25-kilowatt system will offset their bill, which at $3.51 per watt has a gross cost of $25,447 (tariff included) and a net cost of $17,812 with the 30% Federal Investment Tax Credit ($7,634) and before any additional local incentives are considered. In the next five years, that homeowner will spend $13,200 on electricity, that is 74% of the net cost of the system today.

Explore solar for your home with our solar savings calculator!

Explore solar for your home with our solar savings calculator!

Don’t forget that buying a solar system with cash or a loan adds to the value of the home. A 2015 Department of Energy Lawrence Berkley Laboratory study showed the added value was at least as much as what was spent purchasing the system. What’s more, solar homes sold faster than non-solar homes.

Or they could not go solar, and continue “renting their electricity from the utility”. Instead of paying off an asset on their home, they have delayed an investment for a solar system with a 25-year savings of $89,000!

In this way, solar reminds us of the age-old proverb about the best time to plant a tree. In this case: the best time to install a solar system was 20 years ago. The second best time is today.